- CompoSecure Announces Strategic Spin-Off of Resolute Holdings Management, Targets Asset Management Growth

- ETF Stream’s portfolio more than doubles benchmark return in 2024

- How to review your mutual fund investment portfolio in 2025

- Investment in 2025: ‘Dedicate 80% of portfolio to…’: Edelweiss Mutual Funds’ Radhika Gupta shares tips on MF allocation

- Brookfield Asset Management Announces Renewal of Normal Course Issuer Bid

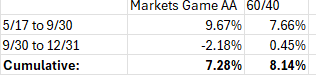

Similar to the stock portfolio, the asset allocation portfolio is doing fine but saw some turbulence in December. Both stock and asset allocation tend to look dumb in one-decision markets. Just buy high beta things like growthy tech and bitcoin and call it a day, right?

Bạn đang xem: The Markets Game Asset Allocation Review

Xem thêm : Five New Year’s Investment Resolutions

That can look brilliant in the short-term but produce ugly results over the long-term. Back in 2000, internet stocks had been multiyear darlings and there were serious people engaging in FOMU (fear of material underperformance) feeling forced to participate. When you make 300% in three years and lose 80% in three months, you lose 40% of your money. (You can see that by typing something like $1,000 into your calculator, multiplying by three, then multiplying by 0.2.)

Diversification has been described as the only free lunch in investing by Harry Markowitz, the creator of Modern Portfolio Theory, which informed so much of how financial advisors operate. Nothing is really free, though. Much like investors in 2000, it’s very difficult to diversify when somebody is out there making big money YOLOing crypto coins. Diversification works, but it means there will always be something underperforming.

There’s certainly nothing wrong with taking risky bets, but you can cause enormous damage if they don’t work out. For my part, I started this portfolio after the stock market had already done quite well and the gyrations have been somewhat violent, since. A high beta portfolio would have worked over that time, but with some gut-wrenching swings. Over years, I believe Markowitz is right that diversification is very valuable.

Xem thêm : Texas Teachers Returns 12.7% in Fiscal 2024

In this case, I failed to remove something that I’d called a mistake months ago, my investment in the Healthcare sector (XLV.) Fears that RFK will be bad for the sector really put it on the back foot. I’m keeping it because it became oversold and should do well in a slowdown. We’ve seen it perform well so far this year. Also, after, intelligently avoiding Treasurys all year, I started buying in the fourth quarter. While that started well, they since went back to 1Y lows. I took a strong start in Asset Allocation and damaged it with some incautious decisions. I do think there’s a reasonably clear path to do well this year, though.

I’m pretty confident Treasurys will end up doing well this year, it’s just a question of when that starts. While the big money is likely to be made in longer duration bonds eventually, today I modestly increased my position in 2Y Treasurys (I use TUA.) That’s not exciting but given they’re by the lower bound of short rates, downside seems limited. My belief is I can likely get a 15% total return from them over the year, from yield and appreciation, which seems great given the likely lack of risk.

Like with the stock portfolio, I think we’re finally heading to a point where these portfolios can focus more on the long-term, which is what I was originally hoping for. Hopefully I can generate a decent return with the options that are presented.

Twitter: @TheMarketsGame

The author is not a financial advisor & is not responsible for any financial gain or loss that you may incur by acting on the information provided within this newsletter. For investment or financial advice, consult with a registered investment advisor, and/or financial advisor. By reading this newsletter, you are agreeing to these terms, and acknowledge this newsletter is for sharing my personal thoughts and opinions on financial markets.

Nguồn: https://exponentialgrowth.space

Danh mục: News