- Sebi introduces timelines for NFO fund deployment, eases AMC employee interest alignment rules

- Texas Teachers Returns 12.7% in Fiscal 2024

- 2024 Year-end Financial Housekeeping – Retire by 40

- Four considerations for your investments in the new year

- CompoSecure Announces Plan to Spin-Off Resolute Holdings Management, Inc. to Form a Differentiated Alternative Asset Management Platform and Accelerate Value Enhancing Acquisitions for CompoSecure

Report Overview

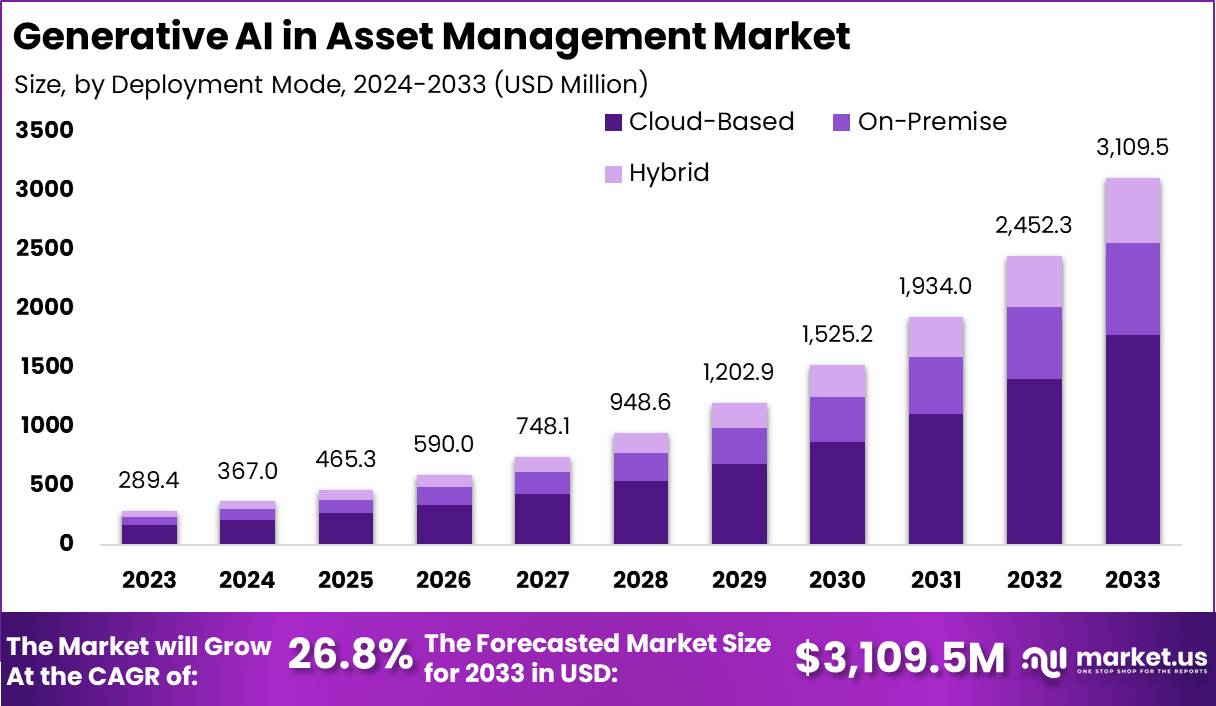

The Global Generative AI in Asset Management Market size is expected to be worth around USD 3,109.5 Million by 2033, from USD 289.4 Million in 2023, growing at a CAGR of 26.8% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 47.6% share, holding USD 137.7 Million revenue.

Bạn đang xem: Generative AI in Asset Management Market Size

Generative AI in asset management refers to the usage of advanced artificial intelligence methods including generative models, Generative Adversarial Networks (GANs), and Variation Autoencoders (VAEs), to enhance asset management practices. Generative AI empowers asset management by enhancing foresight through the evaluation of a vast amount of data which further aids in knowing the patterns and trends.

The market for generative AI in asset management is growing rapidly, driven by the growing demand for portfolio optimization, effective investment decision-making, improved efficiency, and the integration of digital wealth management. Moreover, there is a rapid growth in global wealth, thus leading to the increased need for potential assets or wealth management tools.

For instance, according to the World Intellectual Property Organization (WIPO), there is an increase in asset investments across the globe. Investment in intangible assets like brands, designs, data, and software has grown 3 times faster over the past 15 years as compared to the investments in physical assets.

![]()

The major driving forces behind the rapid adoption of generative AI in asset management include the need for enhanced operational efficiency and improved customer personalization. The technology’s ability to process and analyze large amounts of data rapidly allows for the optimization of asset allocation and risk management processes.

Additionally, the demand for tailored investment solutions and strategies has propelled the integration of AI tools that can deliver personalized financial advice and portfolio management at scale. Market demand for generative AI in asset management is primarily driven by banks, financial institutions, and insurance companies. These entities leverage AI to refine asset management strategies, enhance decision-making processes, and improve customer service through customized financial products.

The push towards digital transformation in the financial sector, coupled with increasing regulatory requirements and competition, has necessitated the adoption of advanced technologies like generative AI to maintain a competitive edge. There are significant opportunities for growth within the generative AI in asset management market, particularly in automating and optimizing back-office operations and compliance processes.

According to the PWC report, Platforms are expected to handle nearly $6 trillion in assets by 2027. This represents a remarkable increase, almost doubling the $3.1 trillion recorded in 2022. Generative AI adoption is gaining significant traction, as highlighted in a recent survey conducted by KPMG. The study shows that in March, 50% of executives indicated their likelihood of allocating budgets to generative AI within the next six to twelve months.

By June, the momentum had grown substantially, with nearly 40% of executives planning to increase their investments in generative AI by 50 to 99%. Additionally, 45% of respondents revealed intentions to double their budgets for generative AI projects.

The continuous advancements in machine learning models, especially in areas like neural networks and natural language processing, have empowered generative AI to become more sophisticated in its applications within asset management. These advancements facilitate the generation of new data and the enhancement of predictive analytics capabilities, allowing asset managers to gain deeper insights into market trends and make more accurate predictions about future market movements.

Key Takeaways

- In 2023, cloud-based solutions dominated the generative AI in asset management market, capturing an impressive 57.3% of the global share. Their scalability and cost-effectiveness continue to drive adoption across industries.

- Portfolio management solutions accounted for over 31.6% of the market share in 2023, underscoring the critical role AI plays in optimizing investment strategies and maximizing returns.

- Asset management firms represented the largest end-user group, holding a commanding 48.7% share of the market in 2023. These firms are leveraging generative AI to improve decision-making and operational efficiency.

- North America emerged as the regional leader, capturing more than 47.6% of the global market share in 2023. This dominance reflects the region’s robust technological infrastructure and early adoption of AI-driven tools.

- According to UBS, average wealth and asset growth surged from 3.7% per year between 2000 and 2010 to nearly 6.3% between 2010 and 2023. This significant growth has created a higher demand for sophisticated asset management solutions, with AI at the forefront.

- Forbes highlights that generative AI could boost productivity in the banking sector by up to 5% while potentially reducing global expenditures by a staggering $300 billion. This transformative potential positions generative AI as a game-changer for financial services.

Deployment Mode Analysis

In 2023, the Cloud-Based segment held a dominant market position, capturing more than a 57.3% share of the Global Generative AI in Asset Management Market. This is primarily driven by the flexibility, scalability, and cost efficiency of the cloud-based platforms.

Cloud-based generative AI solutions offer extensive computational power and storage capabilities, which are required for processing large datasets and running complex algorithms. Cloud-based generative AI solutions reduce the requirement for unique upfront capital investments in the IT infrastructure. This would allow a broader number of asset management firms to leverage advanced AI tools effectively thus democratizing cutting-edge technologies.

Additionally, the cloud-based deployment also aids the rapid integration of AI models, thus ensuring that the asset management strategies are highly responsive to the changing market conditions. It also promotes effective collaboration and accessibility, thus enabling the team and concerned people to access critical data.

Application Analysis

Xem thêm : JBWere expands fixed income offering powered by UBS Asset Management

In 2023, the Portfolio Management segment held a dominant market position, capturing more than a 31.6% share of the Global Generative AI in Asset Management Market. This is attributed to the rising demand for effective decision-making tools in asset management firms. Portfolio optimization technologies help in customizing investment strategies by analyzing a vast amount of datasets with the use of generative AI.

Furthermore, the integration of generative AI into portfolio management streamlines the allocation of assets and substantially reduces the time needed for market analysis and scenario simulation. This in turn leads to more dynamic and effective investment decisions.

This dominance is further supported by the increasing complexity of the financial markets and the increasing volume of unstructured data. For instance, according to MarTech Alliance, the volume of unstructured data is set to grow from 33 zettabytes to 175 zettabytes, or 175 Billion terabytes, by 2025. Ongoing innovations in AI technologies are enhancing the accuracy of predictive analytics, which makes it easier to analyze unstructured data.

End User Analysis

In 2023, the Asset Management Firms segment held a dominant market position, capturing more than a 48.7% share of the Global Generative AI in Asset Management Market. This is primarily due to their investment capabilities and the need for enhanced operational abilities.

Asset management firms are leveraging generative AI technology for effective data analysis, improved decision-making, and development of personalized products/services, as these are the needs of the current financial landscape. Generative AI is known for its advanced tools that enable financial analysis, risk assessment, and predictive modeling with higher accuracy and in less time.

Furthermore, this integration also offers scalability and cost efficiency, thus enabling the asset managers to optimize their operations without a significant upfront investment. Overall, generative AI tends to increase productivity and empowers asset management firms to operate swiftly with the changing market conditions.

![]()

![]()

Key Market Segments

By Deployment Model

- Cloud-Based

- On-Premise

- Hybrid

By Application

- Portfolio Management

- Risk Management

- Client Engagement & Personalization

- Research and Analysis

- Others

By End-User

- Asset Management Firms

- Banks and Financial Institutions

- Insurance Companies

- Corporate Firms

Drivers

Increasing need for better investment decisions

The increasing need for better investment decisions in financial institutions, and banks has been a significant driver for the market. As the financial markets are becoming more complex and volatile, the need for advanced tools that analyze a vast amount of datasets and identify actionable insights increases.

With the help of historical data, generative AI can effectively predict market trends and fluctuations in the market. This allows one to make a proactive decision and adjust the investment strategies in real-time. Additionally, generative AI also facilitates the personalization of investment strategies according to individual client profiles, thus improving customer satisfaction and long-term relationships.

Restraint

Higher initial Investment

Higher initial investment costs tend to restrain the global generative AI in asset management market. Implementing advanced generative AI technologies demands substantial capital for software, hardware, and infrastructure, which can highly impact small and medium-sized firms.

Moreover, the need for specialized training to gain the needed skills adds to the financial strain for the companies. This cost can deter organizations from adopting generative AI as these firms could emphasize short-term cost management as compared to long-term efficiency and gain.

Opportunities

Integration in wealth management digitally

One of the significant opportunities that the generative AI in asset management market has is its integration into digital wealth management to enhance the customer experience and operational efficiency. This could also aid in managing the portfolio with higher efficiency and precision.

Additionally, the integration of generative AI in wealth management would help create a more agile response to the volatile market and provide an enhanced ability to capitalize on various investment opportunities. Furthermore, this would also help wealth managers streamline the internal processes through various technologies such as Natural Language Processes, AI, and Predictive Analytics, thus reducing the time spent on routine tasks.

Challenges

Unavailability of reliable or accurate data

The Unavailability of reliable or accurate data in the current market presents a significant challenge for the generative AI in Asset management market. The effectiveness of the generative AI majorly depends on the quality and the availability of the data. It needs a diverse, extensive, and accurately labeled data set. This aids in training the algorithms that are capable of making real-time decisions and predictions.

However, the financial market faces various issues related to data quality including incomplete datasets, biased information, or insufficient data. This can hamper the reliability and performance of the AI models. This not only restricts the capabilities of generative AI but also generates the risk of suboptimal investment decisions.

Growth Factors

Xem thêm : SutiSoft Announces SutiAMS – The Intelligent Asset Management Software for Modern Businesses

The growth of the Generative AI in Asset Management Market is fueled by several key factors. Firstly, the technology’s ability to significantly enhance operational efficiencies stands out as a primary driver. Generative AI facilitates better decision-making and operational agility by analyzing vast amounts of data to generate actionable insights, which can lead to improved performance metrics such as cost savings and faster response times.

Moreover, the demand for personalized investment solutions is growing, and generative AI’s capacity to tailor services and strategies to individual client needs is proving indispensable. Another significant growth driver is the increasing necessity for robust risk management solutions.

Generative AI enhances the ability to predict market trends and identify potential risks by analyzing diverse data sources, including market data, financial reports, and global economic indicators. This proactive approach in risk assessment helps asset managers mitigate potential losses more effectively

Emerging Trends

Emerging trends in the application of generative AI within asset management highlight the rapid evolution of this technology. One notable trend is the integration of AI in enhancing client experiences through personalized financial advice and portfolio management. This customization is achieved by analyzing client data and market conditions to offer tailored advice, which significantly enhances client satisfaction and retention.

The shift towards cloud-based solutions is another critical trend. These platforms offer scalability and cost-efficiency, enabling asset managers to implement sophisticated AI tools without the substantial upfront investment typically required for on-premise systems. The cloud-based deployment of AI applications ensures that asset managers can remain agile and responsive to market changes, a crucial advantage in the fast-paced financial sector.

Business Benefits

The business benefits of implementing generative AI in asset management are profound and varied. First and foremost, generative AI can automate routine tasks such as data analysis and report generation, freeing up human resources to focus on more strategic initiatives. This shift not only reduces operational costs but also improves employee satisfaction by enabling staff to engage in more meaningful and rewarding work.

Additionally, the advanced analytics capabilities of generative AI allow for better asset allocation and investment strategy formulation. By processing and learning from historical data, AI can uncover investment opportunities that might not be apparent through traditional analysis methods. This capability leads to better-informed investment decisions and potentially higher returns on investment.

Furthermore, the use of generative AI in compliance and risk management cannot be overstated. With increasing regulatory requirements, AI’s ability to monitor and ensure compliance in real-time helps asset management firms navigate the complex regulatory landscape more effectively, thereby reducing the risk of penalties or reputational damage.

Regional Analysis

In 2023, North America held a dominant market position in the Generative AI in Asset Management Market, capturing more than a 47.6% share with revenues amounting to approximately USD 137.7 million. This significant market share is driven by several key factors that underscore the region’s leading role in the adoption and integration of generative AI technologies within the asset management sector.

Firstly, the robust financial ecosystem in North America, coupled with high technology adoption rates across businesses, sets a fertile ground for AI innovations. The region has been at the forefront in embracing digital transformations, which include the integration of AI into critical business operations.

This adoption is heavily supported by substantial investments in AI research and development, which not only drives innovation but also facilitates the rapid deployment of advanced AI applications in asset management. Moreover, the presence of major financial and technological hubs in the United States and Canada contributes to this dominance.

These hubs are home to numerous startups and established companies focusing on AI and machine learning, which continuously push the boundaries of what’s possible in asset management. The collaborative environment between tech companies and financial institutions fosters unique innovations and solutions that are tailored to the complex needs of asset managers.

![]()

![]()

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading company operating in the Generative AI in Asset Management market is Blackrock Inc. It is an American multinational investment company that provides advisory and risk management solutions. in addition, the organization also delivers services such as cash management, security lending and client insight unit.

Another prominent firm is Numerai, known for its proactive technological adoption. This hedge fund platform uses a combination of artificial intelligence, blockchain technology, machine learning and data science to enable a balanced economic model.

Top Key Players in the Market

- BlackRock

- Numerai

- Kensho

- Two Sigma

- Vanguard

- State Street

- Aptiv

- Qplum

- XTX Markets

- QuantConnect

- ServiceNow

- SAS

- Other Key Players

Recent Developments

- In September 2024, BlackRock is preparing to launch a more than $30 bn artificial intelligence investment fund with technology giant Microsoft to build data centers and energy projects to meet growing demands stemming from AI. The financial partnership, which BlackRock is launching with its new infrastructure investment unit, Global Infrastructure Partners, would be one of the biggest investment vehicles ever raised on Wall Street.

- In June 2024, Schroders Capital, Schroders’ specialist private markets business with $94 billion of assets under management, unveiled its Generative AI Investment Analyst (GAiiA) platform. This innovation is designed to speed up the analysis of large volumes of data, enabling our private equity investment specialists to focus on delivering value through strategic investment activity to further support our clients’ investment needs.

- In February 2024, S&P Global launched an artificial intelligence (AI) – enabled search on the S&P Global Marketplace (Marketplace). Marketplace is S&P Global’s data and solution exploration platform that represents offerings from all five divisions of S&P Global, Sustainable1, Kensho, and curated third-party providers. Additionally, it proactively recommends other relevant data sets and services, in turn broadening the user’s perspective.

Report Scope

Nguồn: https://exponentialgrowth.space

Danh mục: News