The global financial crisis of 2008-09 led to tightening of capital standards for banks. That, in turn, led to loans to small- and middle-market companies becoming unattractive to banks, shutting out most small and midsize companies from the bank market. Compounding the problem was the 2010 enactment of the Dodd-Frank Act that made it increasingly expensive for small banks to operate, cutting off their supply of loans to small and midsize companies. The result was that private credit rushed to fill the gap that the banking industry was no longer able to fill because of the distress of its balance sheets.

Bạn đang xem: Private Credit: Avoid This Common Asset Allocation Mistake

Another reason for the explosive growth is that corporations have found benefits in private lending that are sufficient to offset their higher yields. Those benefits include:

- Speed of execution.

- No mandated public disclosure of proprietary information.

- Less ongoing disclosure requirements required for fundraising in the public market.

- Avoiding the time-consuming and expensive process of obtaining a rating from one or more of the rating agencies.

- The ability to customize the loan structure to meet the needs of the borrowing company, offering management greater flexibility.

- A borrower facing financial difficulties will find it is easier in a private debt transaction for management to do a workout with only one or a few lenders compared with many lenders in a public bond offering.

Attractions of Private Credit

An example of how rapidly the market has expanded is the Cliffwater Corporate Lending CCLFX. This interval fund invests in private credits to profitable companies that are sponsored by private equity firms with the loans being senior and secured by all the firm’s assets. The fund’s inception was June 2019; in just over five years, it has grown to almost $23 billion in assets (as of Oct. 31, 2024). The attractions that have led to the dramatic growth of the fund include:

- It has daily pricing—shares can be bought daily and redeemed quarterly.

- As an interval fund, it provides a minimum of 5% liquidity per quarter. If a fund is not “gated” (the fund does not receive redemption requests totaling more than 5% of its assets under management), an investor can redeem all their shares. If gated, an investor would receive a pro rata share of the redemption requests.

- All loans are floating rate, with the borrower typically having the option to choose to lock in rates for 30, 60, or 90 days at a predetermined spread over the secured overnight financing rate—virtually eliminating duration and inflation risks.

- At the end of October 2024, CCLFX’s current net yield of 11.4% was 6.8% over SOFR’s 4.8%.

- The average loan/value ratio, or LTV, was just 41%.

- There are limited credit risks due to strong covenants (including covenants that force borrowers to almost immediately negotiate with lenders to preserve loan value and additional fees to lenders in exchange for the granting of loan amendments), support from private equity sponsors, and low LTVs. The Cliffwater Direct Lending Index, or CDLI, has experienced default losses of about 1% per year since inception in 2004. The CDLI-S Index, which includes only senior loans and which are less risky than the loans in the CDLI, has experienced credit losses of just 0.25% since 2010. (Note, this does not cover the 2008-09 financial crisis—the shorter historical series for CDLI-S is attributable to the post-2008 introduction of most senior-only direct lending strategies.)

- It has large premiums over public market debt. The table below documents the performance comparison between the Cliffwater Unlevered, Net-of Fee Direct Lending Index, or CDLI-U-NOF, and public credit benchmarks. The CDLI-U-NOF was created to provide one half of an apples-to-apples private-public credit comparison. Private loan performance is pulled from the CDLI series, which is unleveraged and gross of fees. CDLI-U NOF is different from CDLI in that management and administrative fees are deducted from CDLI returns based upon quarterly BDC disclosures. The resulting quarterly return series parallels the after-fee, unleveraged returns reported by public bank-loan funds, exchange-traded funds, and separate accounts, though not the Morningstar LSTA leveraged-loan indexes, where returns are formulaic and without fees and transaction costs.

Xem thêm : MetLife Investment Management to Acquire PineBridge in $1.2B Global Asset Management Deal

As you can see, investors picked up almost 4% in added net-of-fee return from private credit (7.23% minus 3.31%) despite paying an additional 1% or more in higher expenses. The cost of unleveraged private credit—the difference between the CDLI and CDLI-U-NOF return—has been about 2% per year, while the cost of public credit—the difference between the return of the Morningstar LSTA US Leveraged Loan 100 Index and that of Invesco Senior Loan ETF BKLN—has been about 1% per year. Note also that the volatility of private credit has been lower.

From the Bond Allocation?

A consultant recently asked me to address the following: If I take the allocation to CCLFX from my safe bond allocation, I am going to be increasing my credit risk—risk that correlates with the economic cycle risk of stocks—and the risks are likely to show up at the same time. Thus, while I do have a higher expected return, I am increasing the risk of the portfolio.

While correct, the only right way to see things is in the whole. Let’s assume your bond allocation is to an intermediate Treasury or intermediate investment-grade corporate bond fund. If you create (or increase) an allocation to CCLFX (or other equivalent) by reducing your existing bond holdings, you do increase credit risk. However, while credit risk has increased, your duration and, thus, inflation risk has decreased.

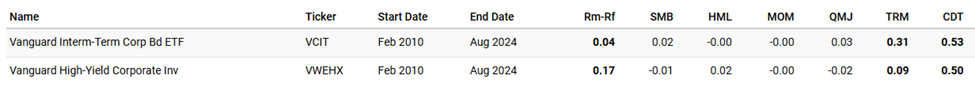

However, just because CCLFX is an alternative to bond funds, the allocation to CCLFX does not have to come entirely from your bond allocation. The right way to think about the allocation is that just like public corporate bonds, CCLFX has credit risk—risk that is related to the economic cycle risk of stocks. We can see this when using the regression tool available at www.portfoliovisualizer.com analysis on Vanguard Intermediate-Term Corporate Bond ETF VCIT and Vanguard High-Yield Corporate VWEHX. The table below covers the period from December 2009 to September 2024. As you can see, both funds have some equity market risk (market beta, or Rm-Rf), both have term risk (with VCIT having significantly more), and both have significant exposure to credit risk.

The analysis gives us the answer to where one should take the allocation to CCLFX from: both stocks and bonds. If instead of a 60% stocks/40% Treasury bonds portfolio one created a 55% stocks/10% CCLFX/45% Treasury bonds, the exposure to the economic cycle risk of stocks would have been reduced by far more than the incremental credit risk versus Treasuries would have gone up. This is because stock allocations typically have a beta of 1, while we might estimate the credit exposure (related to the risk of stocks) of CCLFX to be about 0.5. We can see its exposure to market beta is very low and that the duration (term) risk and inflation risk went down. The net effect is that the portfolio’s overall risk clearly has been reduced, especially for those investors exposed to inflation risk. For those investors who already allocate to public corporate credit funds such as VCIT or VWEHX, the attractions from the perspective of overall portfolio risk are even greater if one reduced or eliminated those exposures and replaced them with CCLFX.

Xem thêm : A Growing Asset for Investors

Of course, risk is just one side of the coin. We also need to think about returns. Given a current CAPE 10 earnings yield of about 3% (even adjusting for accounting rule changes related to intangibles), we should expect real future returns to US stocks of about 3%. If we add the difference in yield between 30-year Treasuries and 30-year Treasury Inflation-Protected Securities, we get an estimate of future inflation of about 2.3%. Together that provides an estimate of future stock returns of 5.3%. And the current five-year Treasury yield is 4.16%. Now compare those yields with the 11.4% yield on CCLFX.

Bottom line is you reduced economic cycle risk, you reduced duration and inflation risk, and, thus, reduced overall portfolio risk while increasing expected returns. Is that a free lunch? Clearly not, as some of the incremental yield of CCLFX is liquidity risk. But for those investors who can allocate at least 10% of their portfolio to semiliquid assets (remember you can redeem at least 5% every quarter at a minimum), that is as close to a free lunch as one can get!

A word about asset location: Because of the tax inefficiency of private credit, taxable investors should prefer to hold private credit in tax-advantaged accounts.

Investor Takeaways

The first takeaway is that given the choice of private and public credit, the data strongly points to investors allocating most, if not all, their credit allocation to private solutions. The second is not to make the mistake of only considering taking an allocation to private credit from the bond allocation.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future.

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

Nguồn: https://exponentialgrowth.space

Danh mục: News