- Where Commodities Have A Place In A Growing Investor’s Portfolio

- Bybit Launches Private Wealth Management Service For High-Net-Worth Investors

- Marcus Erikson Introduces Revolutionary Strategy for Growth

- The Best Flexible Strategies for Retirement Income

- Financial Giant BlackRock Endorses Up to 2% Bitcoin (BTC) Allocation in Multi-Asset Portfolios: Report

The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly.

Bạn đang xem: Asset Allocation – Prometheus Research

If you’re unfamiliar with our approach to macro, we have a series of notes that offer our mechanical understanding of macro conditions. You can find these Macro Mechanics notes below:

We highly recommend using these resources to understand our macro-investing approach. They will make the content below much more digestible. Let’s dive in.

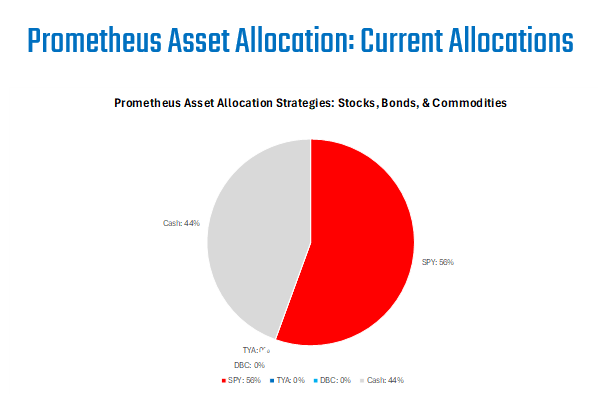

Prometheus Asset Allocation is currently positioned as follows: SPY (56%), TYA (0%), DBC (0%), and Cash (44%). This allocation is consistent with a long-term expected volatility of 10%. A 5% loss across all positions would lead to a -2.78% loss for the portfolio. Positions visualized below:

Our asset allocation program continues to see stocks as the best asset among stocks, bonds, and commodities. However, across our systematic strategies, we see signs of prospectively weaker equity markets than in the recent past. The Prometheus Asset Allocation program is designed to have a constant 10% volatility exposure to risk assets, so our systems maintain a relatively larger exposure than our other programs. This program seeks to be long assets, and equities look most attractive at the current junction. We dive into the data driving these allocations in the next section.

Our macro-monitors are how we comprehensively track conditions across growth, inflation, and liquidity across hundreds of variables. We center our analysis around these variables because they are the principal drivers of assets over a six-to-eighteen-month period. Our approach is to track economic and financial market conditions to get the best probabilistic understanding of how macro conditions will evolve.

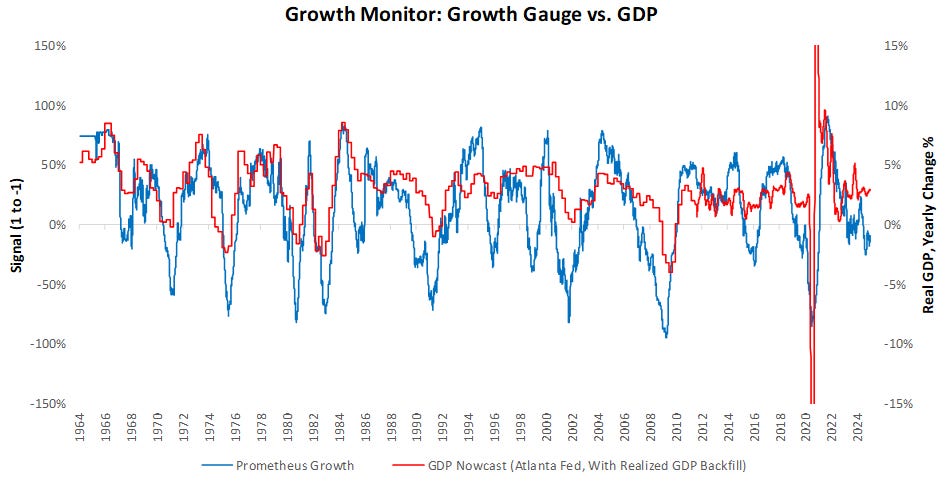

We start with growth. Our Growth Gauge aggregates data across hundreds of economic growth variables to create a timely read of forward-looking macro pressures on GDP growth. We show this below:

Pressures on GDP growth remain for GDP to slow, which we expect to flow through to popular nowcast measures over the next few months.

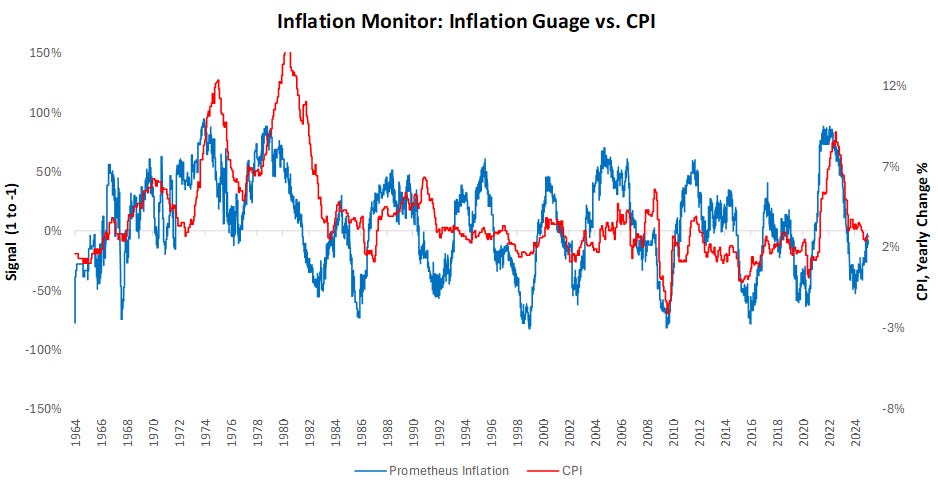

Turning to inflation. Our Inflation Gauge, which, much like our Growth Gauge, aggregates data across hundreds of economic growth variables to create a timely read of forward-looking macro pressures on future inflation.

Inflationary pressures are now neutral, suggesting that inflation can continue at its current pace.

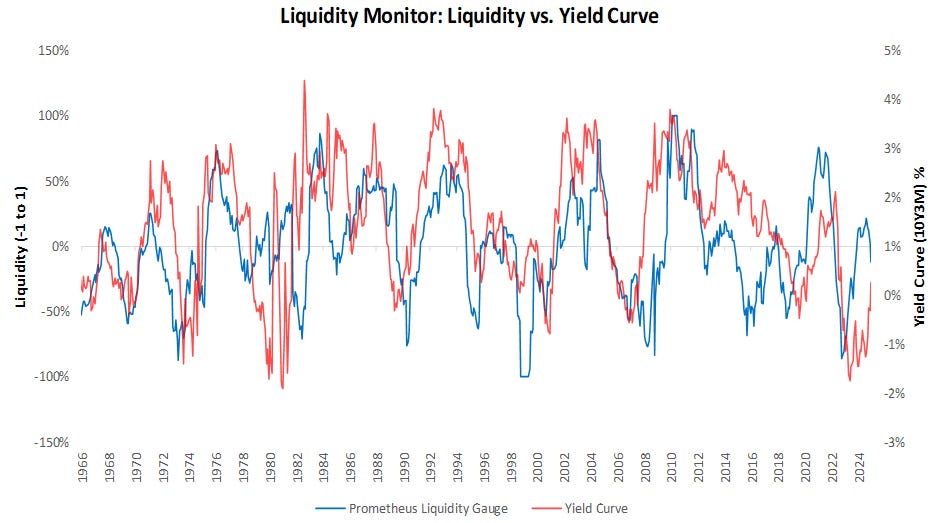

Turning to liquidity, our liquidity gauge aggregates measures of liquidity across the public and private sectors, representing trillions of dollars of liquid assets. It allows us to estimate the potential for risk-taking in the financial system in real-time.

Today, liquidity conditions have begun to show a modest slowing, consistent with the recent volatility in repo markets.

In summary, growth will likely continue slowing, inflation will be neutral, and liquidity will fade. In the next section, we will take a deeper look at the underlying GDP conditions driving these changes.

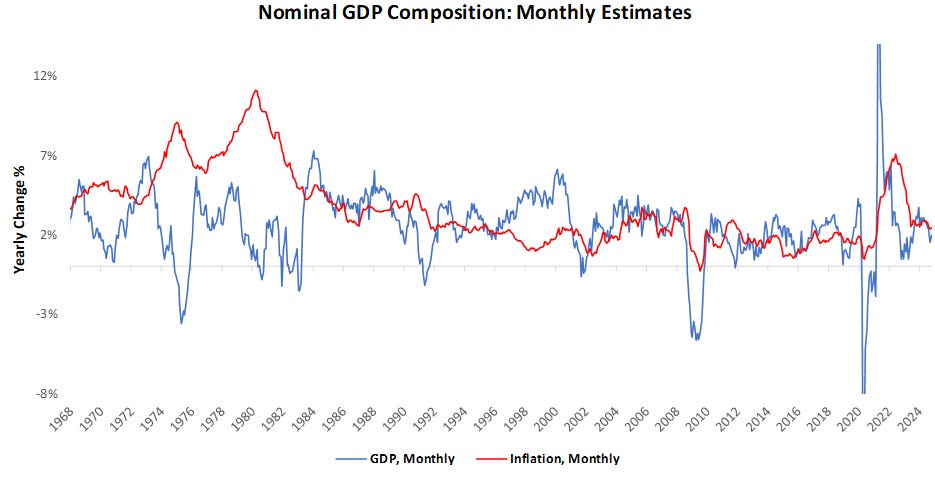

Our GDP forecasts economic data across 75 measures of real growth conditions to understand the economic conditions in a timely manner. We show the composition of monthly nominal GDP estimates, broken into real GDP growth and inflation.

Our latest estimates place nominal GDP at 4.19% versus one year prior, with real GDP growth of 1.67% and inflation of 2.52%.

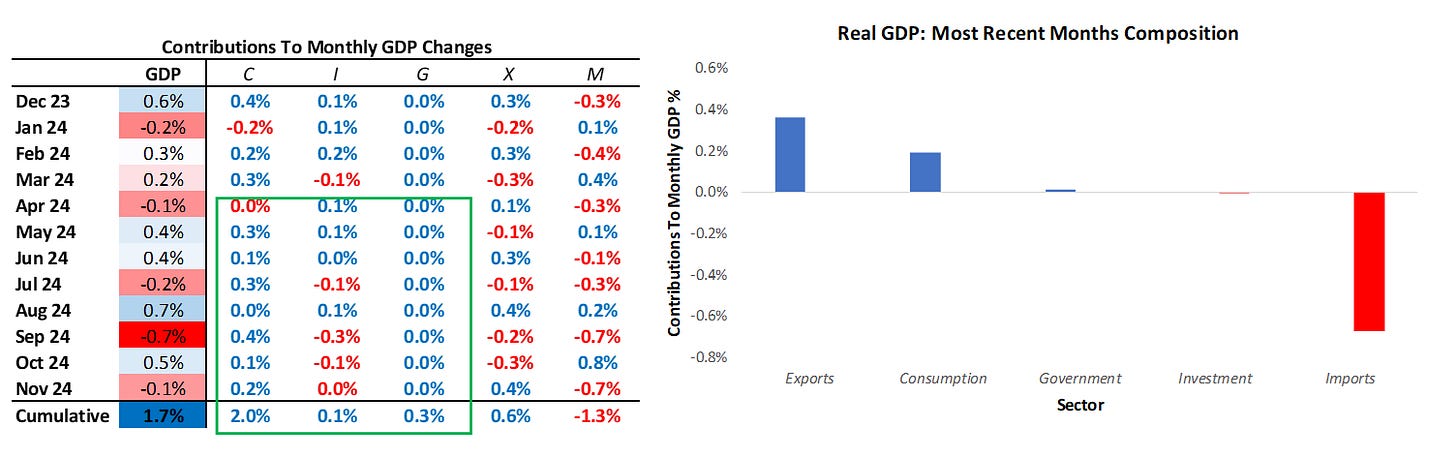

We show the contributions to the monthly nowcast numbers below, which compound into the yearly real GDP numbers:

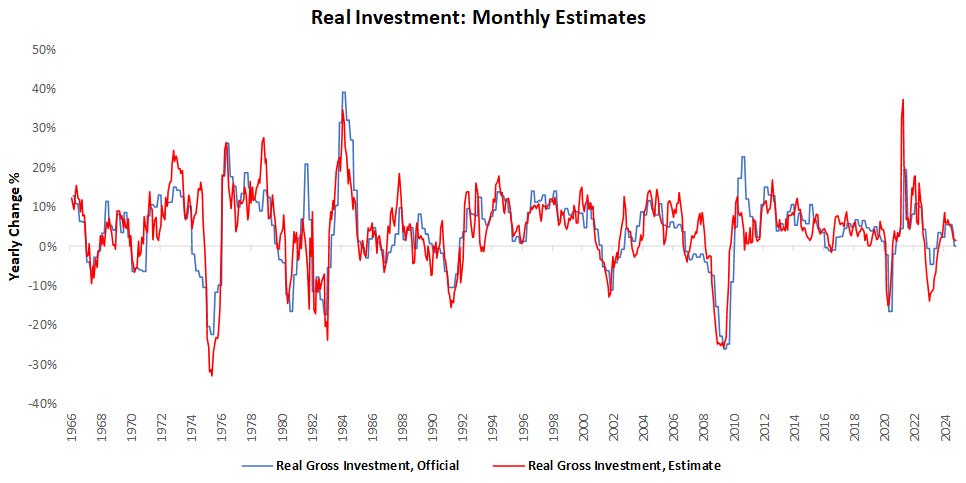

As we can see above, investment data has begun to slow over the last quarter, dragging on our estimates of GDP growth. We now zoom out to understand the broader context by major GDP category.

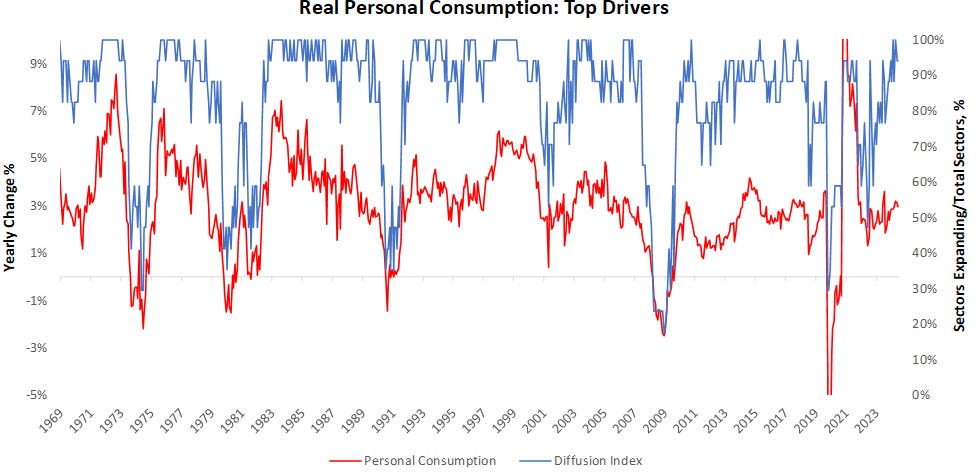

We state with consumption. Consumption is the dominant driver of economic growth over time. We visualize the ongoing pace of consumption growth and the diffusion of the underlying sectors:

Consumer spending growth is expanding across almost all major sectors. This dynamic is almost entirely inconsistent with a recession.

Xem thêm : markets: NRI Talk: Why NRIs are increasing equity allocations in their investment portfolios

Turning to investment. The dominant driver of business cycle conditions is gross investment. This investment comes in the form of construction, equipment, and inventory purchases.

Currently, construction spending has begun to slow, alongside equipment spending. Intellectual property investment remains resilient. Inventory accumulation has begun to slow as well. This is a significant weight on overall economic growth.

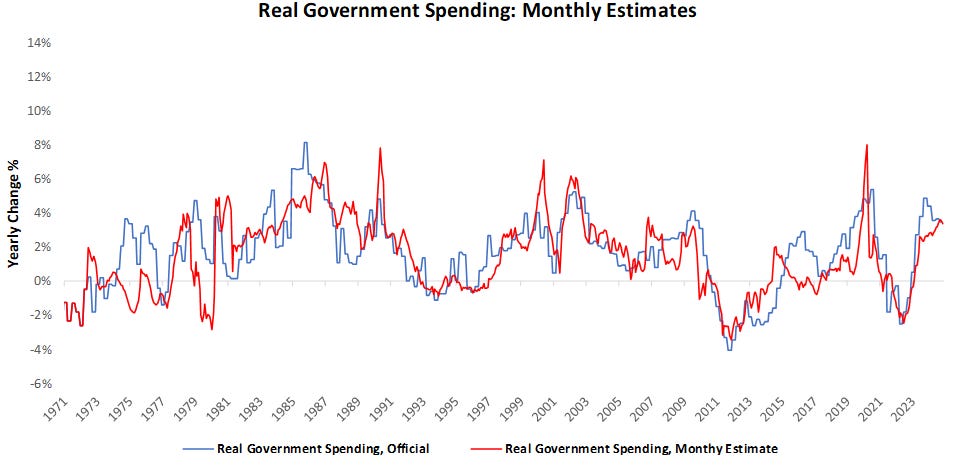

Next, we turn to government spending. Government spending can be an important part of economic growth but is largely secondary to private-sector spending.

Government spending is currently on the rise and has been elevated relative to its recent history and to current business cycle conditions—nonetheless, government spending accounts for a small portion of GDP.

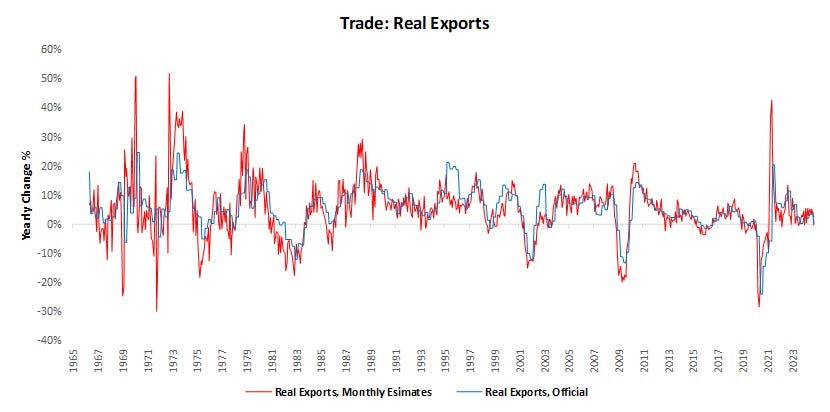

We move to export data next. Export activity is largely driven by goods output and is a function of domestic production. While exports flow to business topline, their impact on GDP is limited by the drag that comes from imports.

Export activity indicates weak goods output conditions, with weak industrial supplies exports and modestly stronger capital goods exports.

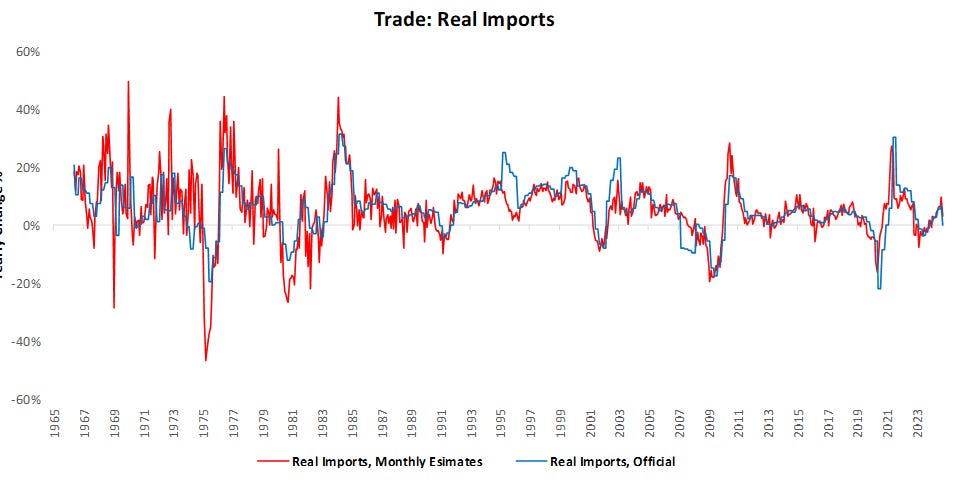

Finally, we turn to the imports. Like exports, imports are dominated by conditions in the goods economy as a function of domestic consumption and production conditions. However, unlike exports, imports drag GDP despite being indicative of economic conditions.

Currently, imports have begun to slow as business investment slows.

In summary, investment activity has weakened, but consumption and government spending are keeping economic growth going strong.

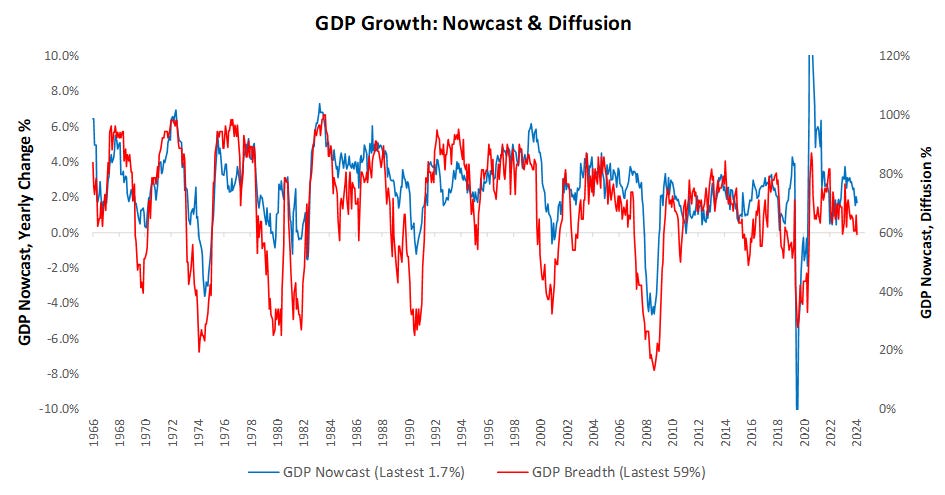

Given the breadth of data our Nowcast covers, we can look across all of the underlying components to better understand the composition of growth. We share both the current level of the nowcast in blue, along with a diffusion index of the underlying components in red:

GDP breadth has begun to weaken, largely driven by weakness in investment-related items.

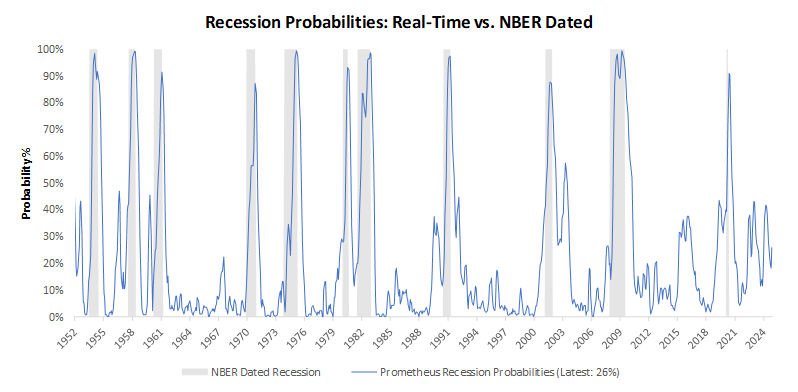

These changes modestly increase recession risk. For a timely insight into recessionary pressures, we aggregate macroeconomic indicators, consistent with the NBER methodology of recession classification, into a recession probability monitor. This gauge gives us a real-time understanding of developing recessionary pressures.

Recession probabilities are still muted but have risen to 26%.

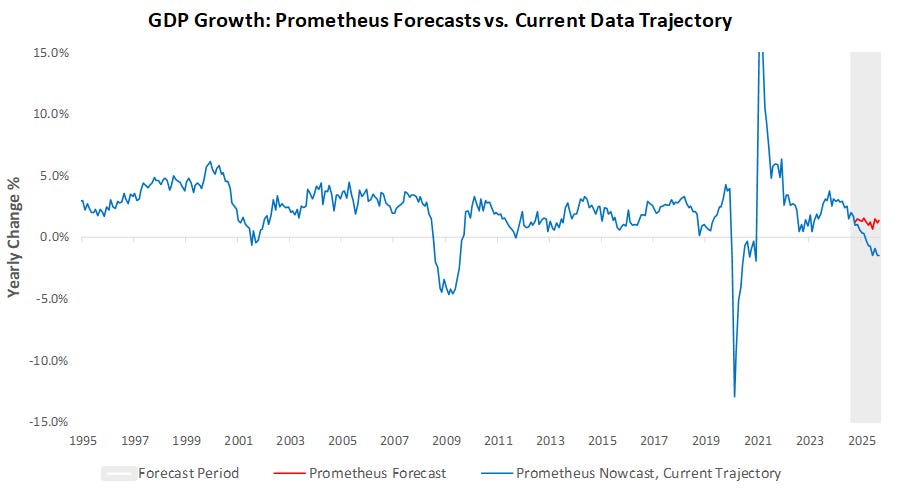

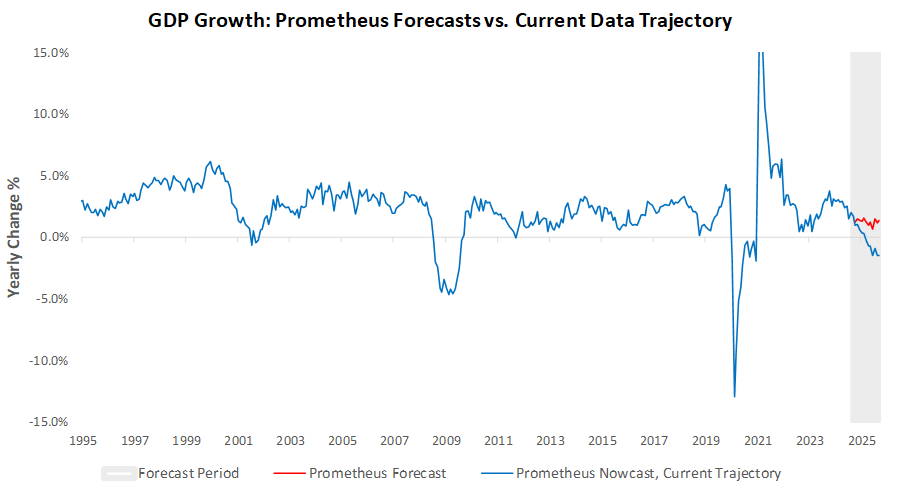

Finally, we can put together all these measures to map the various potential paths for GDP growth. Our data trajectory monitor allows us to visualize the range of outcomes for economic trends over the next year. We share two prospective paths. First, we extrapolate the current trend in the data to visualize the prospective trajectory of GDP based on the current trend. Additionally, we share our forward-looking estimates for real GDP growth based on our proprietary process:

Thus, while GDP has begun to deteriorate, our systems expect slightly better growth than recent weakness implies. Our systems expect real GDP growth of 1.4% over the next year, which is still a material slowing.

We’ve outlined our broad economic views here. The value of these views is relative to what’s discounted in asset prices. If the views are priced in, there are no significant investment opportunities. We share some lenses we use to evaluate what’s priced in.

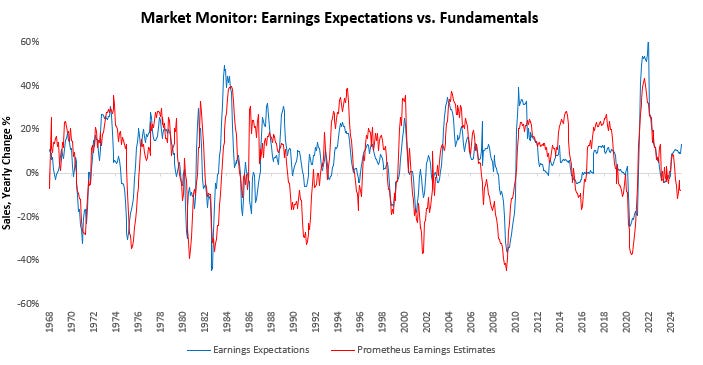

We start with equities. Earnings expectations drive equity markets. Earnings expectations are largely a function of the ongoing macroeconomic impulse experienced by businesses. As such, earnings expectations largely align with realized profits, though they can lag occasionally, creating opportunities.

Earnings expectations remain rich to our fundamental macro estimates. Our systems expect the economy to slow, but earnings expectations continue to rise. The mispricing is growing.

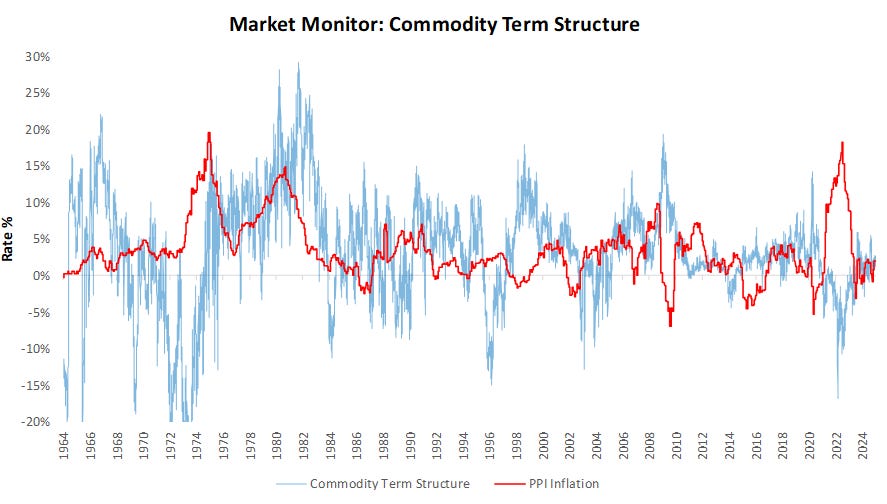

Moving to commodities. What’s priced into commodities is reflected in the commodity term structure. The commodity term structure is a function of demand and supply forces for commodities, shaped by the ongoing inflationary trend in markets. While commodity term structure is related to the ongoing pace of commodity inflation, it can diverge meaningfully based on cyclical circumstances.

Commodity markets continue to price a more inflationary backdrop than warranted by macro pressures. This dynamic will continue to weigh on commodities.

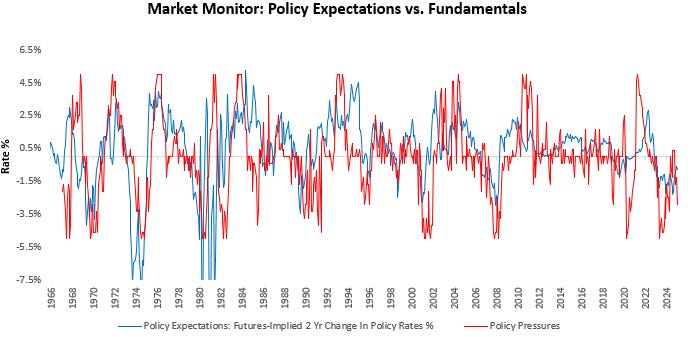

Finally, we turn to treasury bonds. Expectations of monetary policy drive treasuries. Policy expectations are a function of how fundamental growth and inflation data evolve relative to the Fed’s objectives of full employment, price stability, and financial stability. The more divergence between the realized outcomes and the Fed’s objectives, the more policy pressure to move interest rates.

Xem thêm : Public companies’ “Coin Hoarding Trend”: Is Bitcoin becoming the new favorite for asset allocation?

Employment, price stability, and financial stability are now consistent with a modest easing of monetary policy, which is largely reflected in treasury markets.

Overall, equities and commodities continue to look rich. Bonds are now looking closer to neutral.

Markets are continuously pricing future probabilities, and using our understanding of cross-asset pricing; we can infer the probability that markets pricing is in rising or falling growth, inflation, or liquidity conditions. This process of regime recognition allows us to understand the probability of a macroeconomic environment as evidenced by cross-asset movements— which allows us to identify the dominant and durable trend in markets. This feature is critical as it allows us to visualize if market probabilities are moving to confirm our expected outlook for the macro-economy on the margin, thus creating opportunities to potentially buy assets as they rise and short them as they fall.

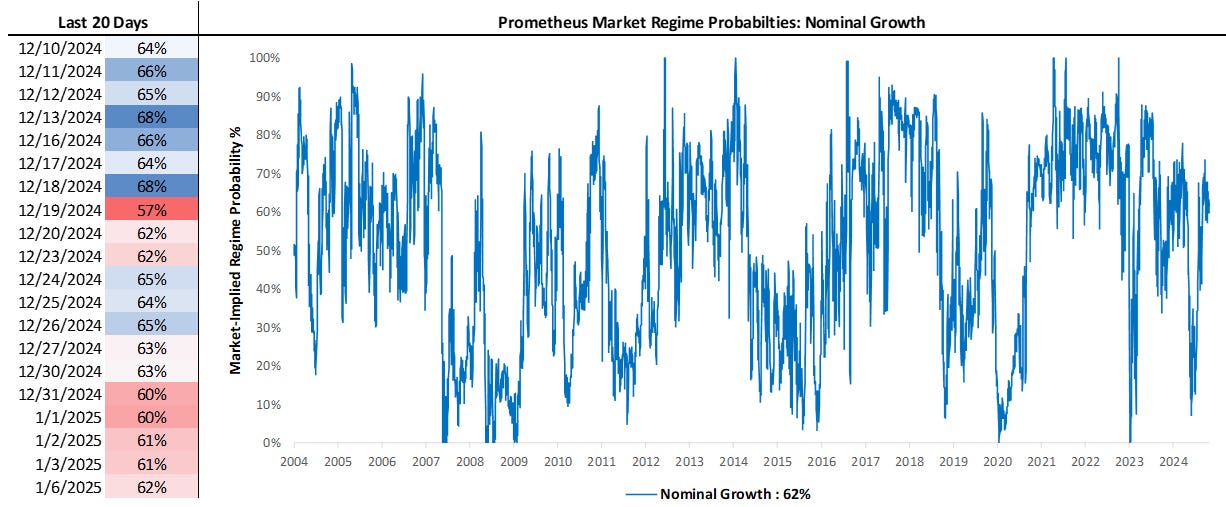

Let’s start with market-implied probabilities of rising growth:

The odds of a rising growth regime remain flat, though still comfortably above the 50% threshold. This modest support for risk assets.

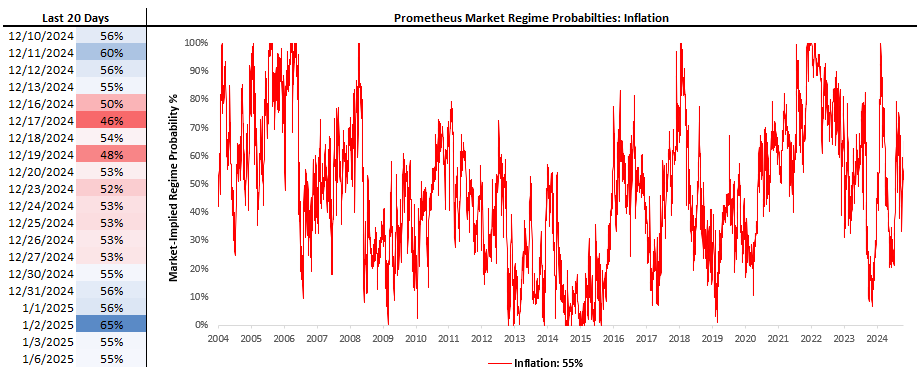

Turning to market-implied probabilities of rising inflation:

Inflationary odds remain neutral, consistent with the underlying macro fundamentals.

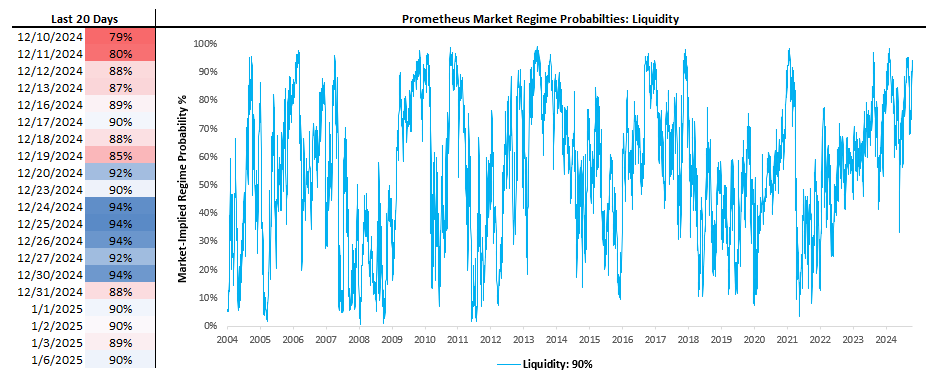

Turning to market-implied probabilities of rising liquidity.

Liquidity conditions continue to power ahead, weighing on bonds but benefitting equities and credit. The situation remains at odds with fundamental dynamics, but there is no trend to fight.

Overall, our market regime probabilities show a dominance of rising liquidity conditions, which is generally favorable for stocks and commodities relative to bonds. However, fundamentals do not support this regime, suggesting a potential lack of regime persistence.

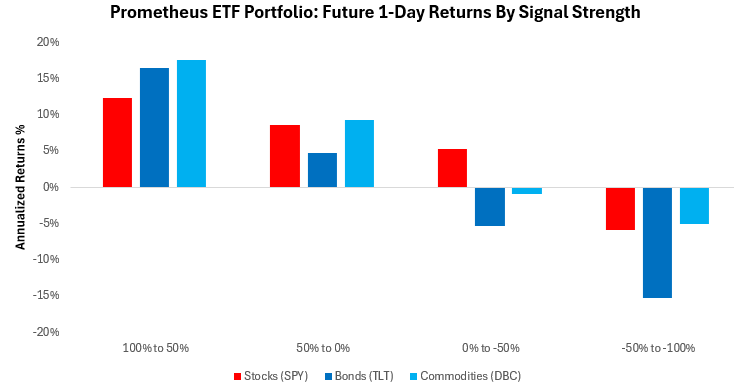

We’ve shared our assessment of current fundamentals, forecasts for the future, evaluation of market discounting, and quantification of cross-asset pricing. Our systems combine these dimensions to create asset class signals for stocks, bonds, and commodities. These signals have largely been good predictors of future returns. We visualize the expected one-day returns based on our signal strength, which was simulated back until 1965:

Please note that these signals are from our ETF Portfolio program (weekly)and are much more high-frequency than those applied to the Asset Allocation program (monthly). However, they offer important informational value and can often front-run the asset allocation program.

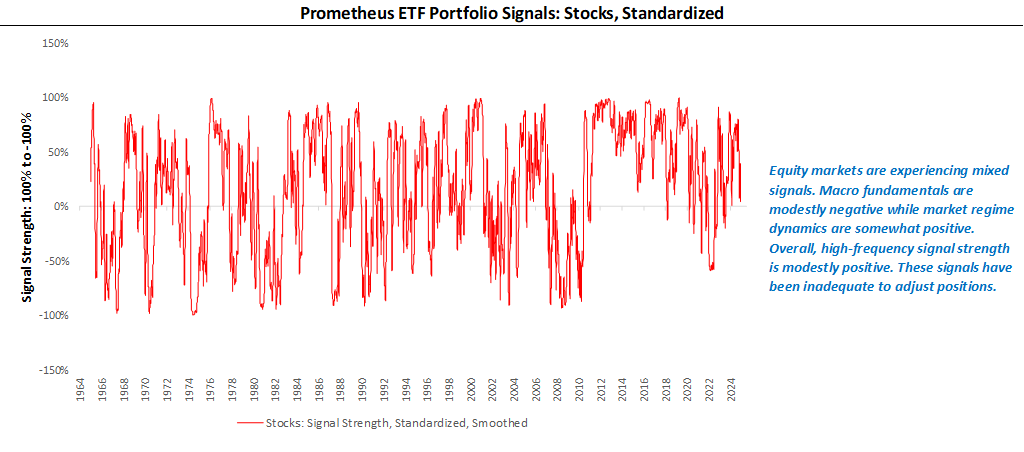

Starting with stocks.

Equity markets are experiencing mixed signals. Macro fundamentals are modestly negative, while market regime dynamics are somewhat positive. Overall, high-frequency signal strength is modestly positive.

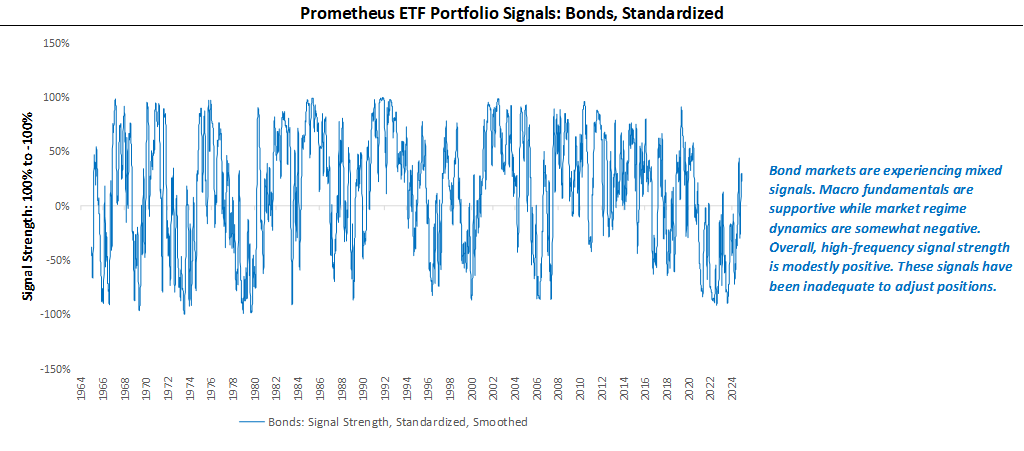

Turning to bonds.

Bond markets are experiencing mixed signals. Macro fundamentals are supportive, while market regime dynamics are somewhat negative. Overall, high-frequency signal strength is modestly positive.

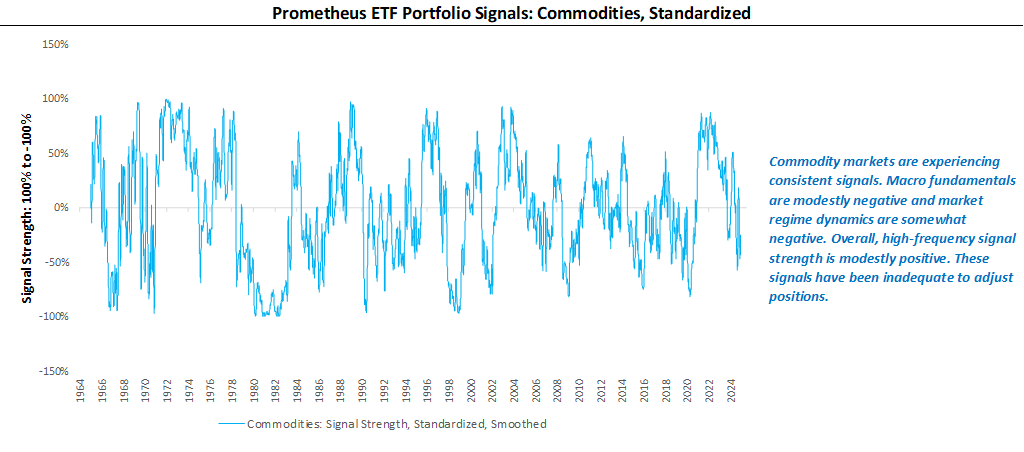

Closing with commodities.

Commodity markets are experiencing consistent signals. Macro fundamentals are modestly negative, and market regime dynamics are somewhat negative. Overall, high-frequency signal strength is modestly positive.

The confluence of macro pressures doesn’t look great for stocks, bonds, or commodities. The economy will likely continue to expand but stay in a slowdown with neutral inflationary pressures and a repricing of liquidity conditions. Stocks remain the best asset in the cross-section.

You can find the data deck attached below as well.

Until next time.

Nguồn: https://exponentialgrowth.space

Danh mục: News